THIS ONLY APPLIES TO OUR AFFILIATES AND PARTNERS, IF YOU ONLY PURCHASE SERVICES WITH US AS A CUSTOMER PLEASE DISREGARD AS THIS DOES NOT APPLY TO YOU!!

Please summit your TAX ID/EIN form you received from the IRS or you may also submit a copy of your SSN card instead.

This information is needed for reporting your commissions to the IRS. Going forward, no commissions will be paid without proof of a valid SSN or TAX ID/EIN number.

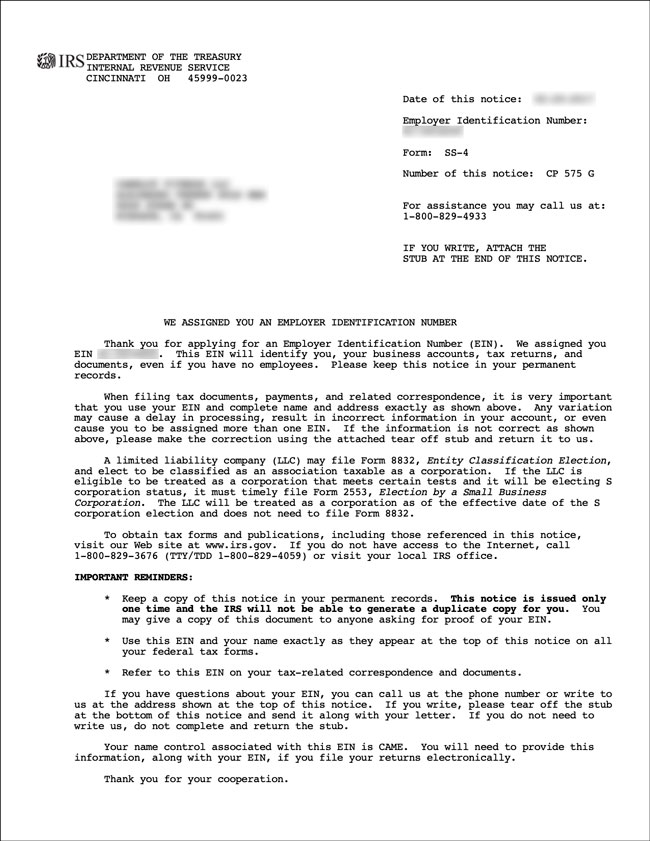

If submitting a TAX ID/EIN number we need the actual EIN Confirmation Letter (CP 575) received from the IRS. Please see example image of EIN Confirmation letter below..

You may also submit a copy of your SSN card instead.

These are the only two documents that are accepted.